Estimated read time: 4 minutes and 50 seconds

🤓 Trivia Tuesday: On various beaches all around the world, shores glow due to a chemical reaction called bioluminescence. A certain island in the Maldives is particularly famous for it. Can you name it?

Good morning and welcome back to Daily Drop, the newsletter that is powered almost entirely by coffee.

At least today it is… But I’ll try to stick around before I inevitably experience a caffeine crash.

Before that happens, let’s talk about travel, shall we?

💳 Credit card statements, explained

🤓 Travel Trivia Tuesday

🖼️ Meme

💳 Credit card statements, explained

I know a lot of you have recently opened credit cards due to the fact that 2023 has been the bee’s knees in terms of high-quality welcome offers…

A friend of mine who recently opened their very first travel card asked me a question that I think many of you may be wondering about too:

“If my credit card utilization is supposed to be as low as possible, how am I supposed to rack up any meaningful rewards while barely spending on a card?”

After about an hour of ranting about credit cards and evangelizing the gospel of travel hacking, I realized that there are quite a few misconceptions about how credit card statements, interest, utilization, etc., work.

So let’s have a chat. Why don’t you come take a seat, young Padawan?

And if you’re already pretty well-versed in this stuff, give it a read anyway, I have some tips that might still help you.

First, let’s define some terms (you WILL be quizzed on this):

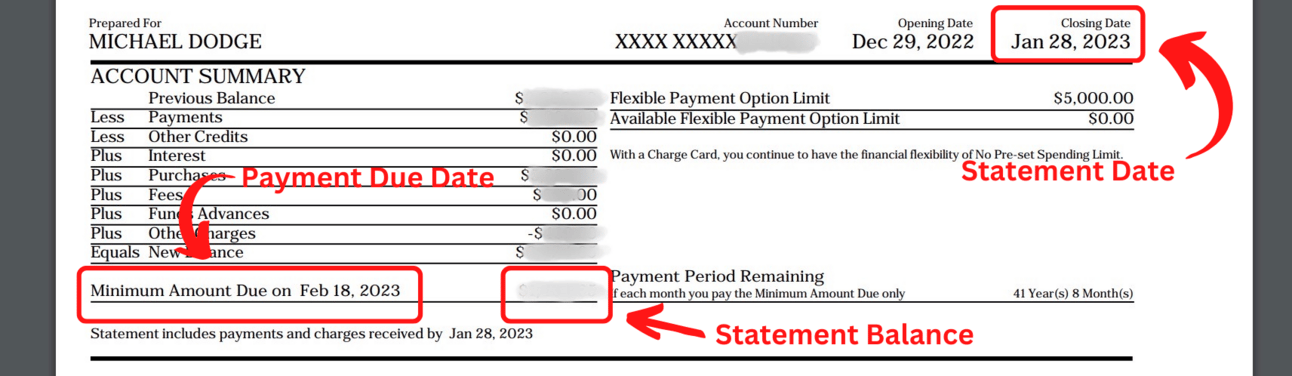

Statement Balance: The amount of money you owe on your card at the time of your Statement Date

Utilization: your Statement Balance as a percentage of your credit limit

Statement Date: the once-monthly date that ends each monthly spending period for a card.

Payment Due Date: The date by which you have to pay your statement balance without incurring any interest.

So let’s talk about Utilization first.

If you have a credit limit of $1,000 and your Statement Balance is $300, your Utilization for the month will be 30%.

You may have heard that to not hurt your credit score, you want your Utilization to be under 30%. But in reality, you want your balance to be more in the 2-5% range to give your score the most significant possible boost.

This shows the credit bureaus that you can manage your credit responsibly and that even though you have a certain amount of credit available, you don’t want to/need to use every last bit of it.

So back to the question at hand:

“If 2% Utilization is what you should aim for, how am I supposed to earn points on just $20 of spending per month…?”

This is where most people misconstrue things. You see, your Statement Balance is different from the amount of money you spend during the month.

I know that sounds confusing… hear me out.

Just because your Statement Balance should end at $20 doesn’t mean you can’t spend more than that. It just means that before your statement closes, you want to PRE-pay the correct amount to manufacture the ideal balance.

Let’s take an example of a card with the following parameters:

Let’s say it’s the 25th of the month and your statement is closing in three days or so. Your current balance is $4,100, putting you at an 82% Utilization… which is bad.

Remember, your Utilization for the month is only determined by your balance at the time of the Statement Date, which isn’t until the 28th.

So all you need to do is make a prepayment of $4,000 in the next few days. This way, your Utilization by the time your Statement Date comes will only be $100, or 2%… which is good.

Now this brings us to the next misconception, which is:

“If I want to pay my card in full to avoid interest, why don’t I just prepay the ENTIRE amount so I have a 0% Utilization?”

Here is the answer:

Your Statement Date and Payment Due Date are two different dates.

As long as you pay your Statement Balance by the Payment Due Date, you won’t incur any interest.

The Payment Due Date generally comes a few weeks after the Statement Date, giving you plenty of time to pay your bill without racking up unnecessary interest charges. In the example above, the Payment Due Date is March 15th, meaning you have two full weeks to pay your balance without any interest.

Here is an example of a statement from one of my own cards, showing where you can find each piece of information.

One way to ensure your card is paid on time is to set up automatic payments, which most card issuers allow.

As a side note, prepaying your card before the Statement Date in order to get a 0% Utilization won’t do you any favors. In the eyes of the banks and credit bureaus, this tells them that you aren’t using your card or credit at all.

It’s definitely better than having a high Utilization, but not as good as keeping a low one to show that you’re both using your credit and using it responsibly.

I know this sounds tedious, especially if you juggle multiple credit cards...

But it’s essential to take this stuff seriously and ensure you understand how the system works. The rewards you earn won’t be nearly as meaningful if you destroy your credit while earning them.

So next time you open up a sweet card and continue your travel hacking journey, make sure you remember these definitions and best practices.

🤓 Travel Trivia Tuesday

Correct answer: Vaadhoo Island

Based on our Daily Drop Travel Tournament, I would hope most of you know the answer... It seems we have some serious Maldives fans in the house.

Vaadhoo is a small island that attracts travelers from all over the world…and for good reason.

This bioluminescence causes tiny glowing dots to wash up on the shore, similar-looking to stars.

The best time of year to see this occur is between June and October. And if you go and you don’t immediately see anything, splash the water around with your feet. If any plankton is there, the blue lights will start glowing.

As if the Maldives weren’t already magical enough…

You can read more about it here.

🖼️ Meme

This one is particularly poignant for me right now…

Want to help Daily Drop take over the world? Share our newsletter with your friends/family/pets/colleagues/enemies and win some rewards in the process!

Sign up for Daily Drop to grab your referral link!

…or you can just buy these prizes from our website if you want to keep us all to yourself. 😉

That’s all, folks. I hope today’s newsletter helps to clear up some of the confusion around credit card statements, credit scores, etc. - I know it can be overwhelming for those of you who are just starting out in this game.

Thanks for joining me today, and I look forward to seeing you all bright and early tomorrow. ❤️