There are some duos that we all know and love.

Who would Batman be without his Robin? You think Bonnie would’ve been that good at robbing banks without Clyde?

Where would we be without all of those cringy rom-com scenes made possible by Romeo and Juliet?

You get the picture.

But I’m here to tell you that all of those duos are TRASH duos compared to the one I’m about to share with you…

I’m talking about a match made in heave— a REAL love story—the Capital One SavorOne Cash Rewards Credit Card and Capital One Venture X Rewards cards.

The Venture X is a card you all know and love, so I won’t go into too much detail about it. If you need a refresher, take a look at our deep dive on the card.

The SavorOne card is essential for anyone who already owns the Venture X or Venture cards, and I’ll tell you why:

This card has a $0 annual fee, no foreign transaction fees, and unusually high earning rates in plenty of categories.

Now some of you savvy card enthusiasts might be thinking:

“Woah, woah, woah… Isn’t the SavorOne card a cash back card? Since when did we care about cash back cards?” I thought rewards and travel cards were the only ones worth a damn.”

You’re absolutely right - the SavorOne card earns cash back…

… with a big exception.

If you hold the Venture X or Venture cards, you have the option of converting your SavorOne cash back into Capital One miles.

Because the SavorOne has higher earning rates on some categories than the Venture cards do, you’re essentially augmenting your Venture or Venture X card with some higher earning rates.

Let’s look at the SavorOne earning rates compared with Venture X earning rates since I know many of you own the Venture X card.

As you can see, all of the category bonuses on the Savor One and Venture X are different from one another.

And let’s be clear here: those earning rates on the SavorOne card are IMPRESSIVE, especially for a $0 annual fee card.

I mean, 10x transferrable miles on a $0 annual fee card?? That’s unheard of!

Here is a breakdown of which card to use for which purchases to optimize this system:

Travel purchases: Venture X (5x-10x)

Dining and Groceries: SavorOne (3x)

Rideshare and food delivery (with Uber): SavorOne (10x)

General non-category purchases: Venture X (2x)

Entertainment and Streaming: SavorOne (3x)

ALL of your spending will be earning at least 2x points, while most of it will earn even more.

The 10x on Uber and UberEats alone is reason to hold this card. I don’t know about you, but I order UberEats all the time, especially when traveling. I’ve ordered Uber Eats everywhere from Kenya to Japan.

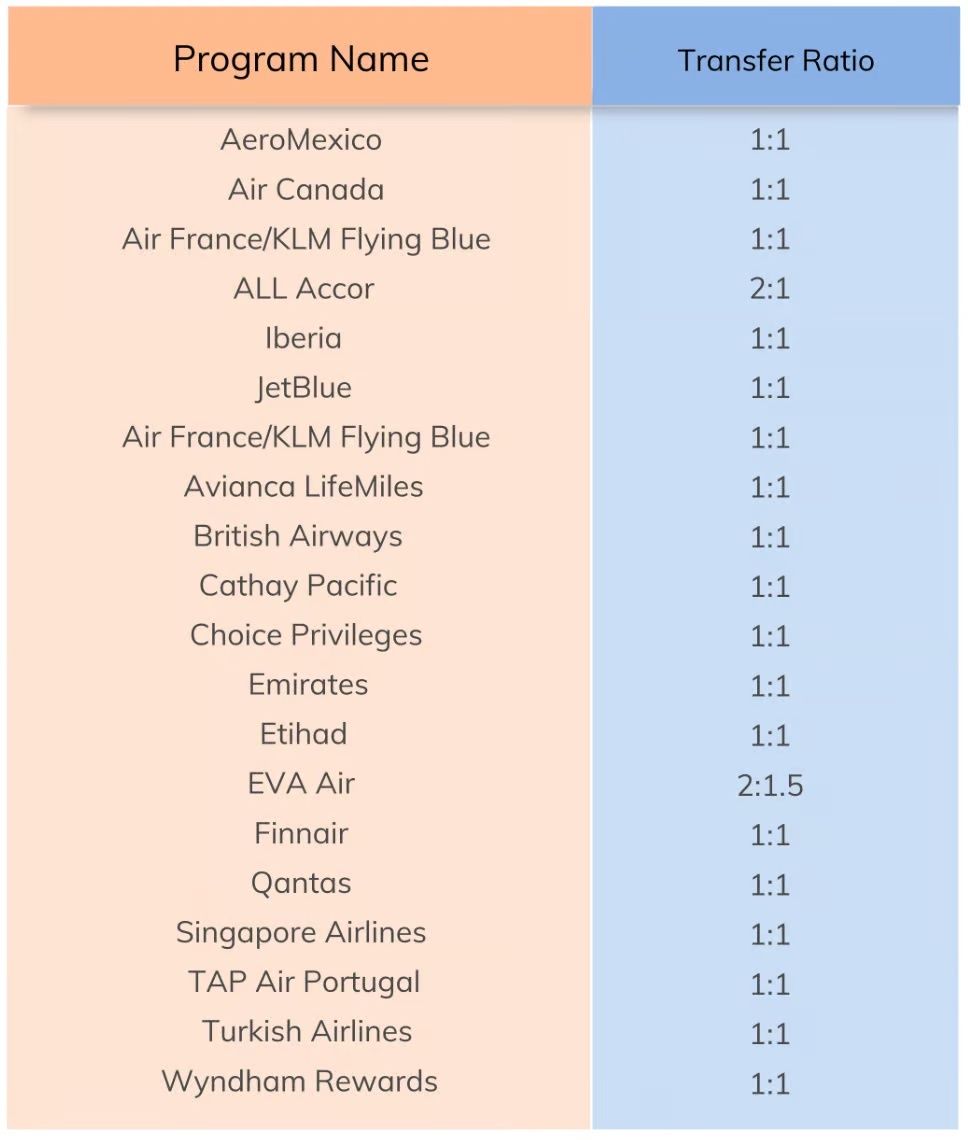

The ability to earn 10x on food and rideshare is insane, especially when you convert that cash back to Capital One miles that can be transferred to various airline and hotel partners, like the following:

Because these two cards are Visas and have no foreign transaction fees, this is also an incredible pair of cards to take on your travels.

I’m a crazy person with WAY too many credit cards because I have a robust system in place for managing them effectively.

If I had to ONLY have two cards, this is the pair I’d pick.

There is no two-card combo with earning rates this high, which is made even more appealing by the $0 annual fee on one of them.

If you’re afraid of the Venture X $395 annual fee, make sure you read our deep dive on how the annual fee pays for itself every year with minimal effort.

Overall, you are a silly goose if you own one of these cards without owning the other, it‘s really a game-changer for anyone looking to maximize travel.

Click the pretty button below to learn more or sign up for the card. 👇